VMware on AWS: Licensing, Pricing, and Strategic Planning for 2026

January 14, 2026

Executive Summary

- VMware on AWS now includes distinct models, which require careful evaluation of ownership, support, and billing.

- VMware Cloud on AWS (VMC) works for extending on-prem environments, but is increasingly a transitional solution as it’s no longer resold by AWS. Currently, Amazon Elastic VMware Service (EVS) aligns with AWS’s roadmap more closely.

- Licensing and pricing vary significantly between VMC and EVS, which impacts long-term costs.

- Migration or optimization depends on workload efficiency, cost, licensing exposure, support model risk, and integration with AWS-native services.

- Nova helps enterprises optimize and migrate VMware environments on AWS by offering managed VMware operations, migration support, and financial guidance to make transitions smoother and more cost-effective.

***

Contact Nova to begin planning your VMware on AWS strategy and optimize your migration path.

VMware on AWS no longer represents a single, stable choice you can set and forget. Instead, ownership models, support paths, and billing controls now vary in ways that affect how you plan risk, cost, and continuity over the next few years.

Keep in mind that VMware Cloud on AWS is no longer resold by AWS, and newer options introduce different long-term dependencies. Those differences matter once incidents occur or renewals arrive.

In this article, you’ll compare how different VMware-on-AWS models shift ownership, support, and cost exposure over time. You’ll see which choices keep options open, and which ones increase reliance on VMware and Broadcom contracts, quietly limiting what you can change later.

What Is VMware on AWS?

VMware on AWS is an umbrella term we use today to describe running VMware environments on AWS infrastructure, but it no longer points to a single operating model. Instead, it now covers two distinct offerings with different ownership, support, and billing boundaries: VMware Cloud on AWS and Amazon Elastic VMware Service.

VMWare Cloud on AWS

VMware Cloud on AWS is the older model. It is still supported, but AWS no longer resells it. Here, VMware manages the SDDC layer while AWS owns the underlying hardware, and you remain responsible for the workloads running on top.

This structure made sense for extending a hybrid cloud. It supported disaster recovery, or placing latency-sensitive applications closer to AWS services without changing how your teams operate day to day. And because vSphere, vSAN, and NSX stay intact, existing VMware workloads move with minimal disruption.

As such, this model is increasingly positioned as transitional.

Amazon Elastic VMware Service

Amazon Elastic VMware Service represents an AWS-owned approach where lifecycle management, billing, and primary support sit with AWS. Meanwhile, customers still require an active VMware/ Broadcom support agreement.

This goes alongside tighter integration with AWS native services and simplified identity and monitoring. VMC still works, but it is no longer where AWS concentrates long-term investment, and neither option removes long-term dependency on VMware tooling or licensing.

If you want to understand this more, feel free to check out this short YouTube video:

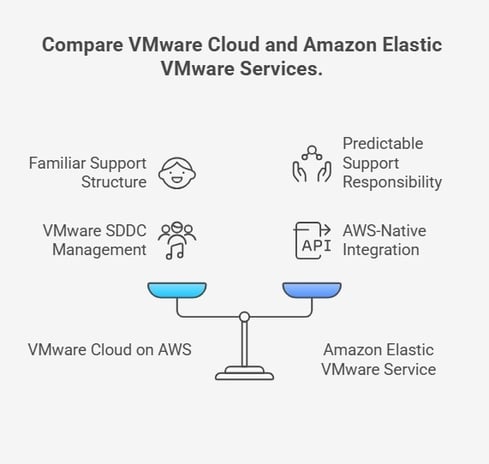

VMware Cloud on AWS vs Amazon Elastic VMware Service (EVS): 7-Point Comparison

At this point, you’re no longer choosing between “cloud” and “not cloud.” Instead, you’re comparing two VMware-on-AWS models that shift ownership, escalation, and cost control in different ways. And that distinction matters once support boundaries tighten or renewal terms change.

VMware Cloud on AWS places SDDC lifecycle management with VMware. AWS supplies the physical infrastructure, while you retain responsibility for workloads and day-to-day operations. This model still fits extensions from an on-prem data center, especially where consistency and low disruption matter.

By contrast, Amazon EVS moves lifecycle ownership to AWS. AWS manages the VMware environment from an infrastructure and platform lifecycle perspective, with primary support flowing through AWS and a required VMware/ Broadcom support agreement alongside it.

As a result, reliance on VMware-managed operations drops, but dependency on VMware licensing and contracts remains. This directly affects long-term governance, escalation paths, and cloud cost management.

So rather than features, the real difference lies in who controls upgrades, billing alignment, and integration with cloud-native benefits across monitoring and identity. The table below summarizes those boundaries at a glance:

| Area | VMware Cloud on AWS | Amazon Elastic VMware Service (EVS) |

|---|---|---|

| Management plane | VMware-managed SDDC | AWS-managed VMware lifecycle |

| Billing model | VMware / Broadcom contracts | AWS account billing plus VMware support contracts |

| Lifecycle owner | VMware | AWS |

| Upgrade cadence | VMware-controlled | AWS-controlled |

| Networking model | VMware NSX-based | VMware networking with deeper AWS integration |

| Integration depth | Limited AWS visibility | Deep AWS-native integration |

| Ideal use cases | SDDC extension, DR | Transitional workloads and modernization paths, not a VMware exit |

Next, it makes sense to look at how each option stands today.

The Current State of VMware on AWS

Right now, VMware on AWS sits in a mixed state. Both models work in production, but they serve different purposes depending on how much control and change you are prepared to take on. And that difference already affects planning conversations.

For VMware Cloud on AWS (VMC)

Today, VMC remains stable and operationally predictable for organizations that prioritize continuity over architectural change:

- VMware still controls the SDDC lifecycle.

- AWS owns the physical hosts.

- You retain ownership of workloads and their behavior.

This split keeps day-to-day operations familiar and limits disruption. As a result, VMC continues to play a role in disaster recovery, hybrid extensions, and environments built on VMware Cloud Foundation, where consistency matters more than change.

At the same time, this structure also defines the ceiling. Upgrade timing, patch cadence, and escalation paths stay tied to VMware’s roadmap. That works well for protection and continuity, but it adds friction when priorities shift toward application modernization or tighter cloud management.

And while past results matter, context matters more.

For example, an IDC study sponsored by AWS and VMware estimated a 479% ROI over five years for organizations using VMC. However, vendor-sponsored studies often reflect specific consolidation scenarios and early migration phases rather than long-term transformation.

Because of that, VMC increasingly functions as a transitional platform rather than a destination.

For Amazon Elastic VMware Service (EVS)

EVS targets a different starting point. It is designed for new deployments and modernization paths where organizations want tighter AWS integration while continuing to run VMware, and where AWS manages the VMware environment lifecycle.

Deeper integration with Amazon CloudWatch, CloudTrail, IAM, and VPC controls shifts responsibility closer to AWS and supports a cleaner operational migration strategy over time. That alignment reduces dependence on VMware-managed operations while keeping VMware functionality available.

Of course, as we explained above, this does not remove VMware licensing or contracts. Complete migration away from VMware still requires a separate effort.

Moving on, it’s time to look at how licensing and pricing shape the real cost of each path.

Pro tip: Are you considering the best migration path for your VMware workloads on AWS? Check out our guide on AWS migration partners to explore how trusted partners can help retail and CPG IT teams reduce risk and drive value.

VMware Licensing and Pricing Considerations for AWS Deployments

Licensing is where VMware-on-AWS decisions start to feel real. Costs don’t rise all at once. Instead, they surface in time through renewal terms, usage patterns, and how tightly your environment stays coupled to a specific model.

Below are the current licensing and pricing realities you need to weigh.

VMC on AWS Licensing

With VMware Cloud on AWS, licensing is tied to clusters and hosts rather than individual workloads. Pricing follows a subscription model that bundles core VMware products, which simplifies procurement but reduces flexibility as usage shifts.

While this structure can be cost-effective for stable environments, it becomes heavier when clusters stay oversized or when growth does not match actual demand, particularly as renewal terms and support policies tighten.

For CIOs and CTOs, the challenge is not list pricing. The challenge is predicting how renewal timing, capacity commitments, and license restructuring interact with real usage over multiple years. In some cases, VMC remains efficient for steady-state platforms or disaster recovery. In others, it becomes cost-heavy once environments stop changing.

And this concern is rooted in actual facts. A survey of more than 1,150 IT professionals found that 46% viewed VMware Cloud on AWS as too expensive, typically after initial consolidation gains had already been realized.

EVS Licensing & Pricing

Amazon Elastic VMware Service introduces a different structure. You still maintain a 1-3 year VMware support contract with Broadcom, but AWS bills infrastructure usage directly through your AWS account.

That model aligns pricing more closely with AWS consumption patterns tied to Amazon EC2 and regional usage. As a result, EVS fits more naturally into cloud migration planning from a cost-visibility and forecasting perspective (without eliminating VMware licensing exposure).

And this is where Nova plays a role. Nova helps you evaluate EVS costs against VMC costs based on licensing, asset posture, and migration readiness. This includes asset relief options such as hardware buy-out and lease-back, alongside bridge support, to plan a controlled VMware exit when timing matters.

Now, let's see how these models affect support and escalation during incidents.

Pro tip: Are you prepared for the evolving costs of VMware licensing? Check out our guide on how VMware licensing costs are changing infrastructure strategy to understand how these shifts impact your long-term planning.

Support Implications for VMware on AWS

Support is where architectural choices turn into operational reality. During operational failures, ownership lines, escalation paths, and maintenance control determine how fast you regain stability. So here’s how the two models differ in practice.

For VMware Cloud on AWS

VMware Cloud on AWS follows a shared responsibility model that stays familiar but rigid. As we explained above:

- VMware owns the SDDC lifecycle, including ESXi, vSAN, and NSX.

- AWS owns the physical host infrastructure.

- You keep ownership of workloads, performance tuning, and application behavior.

As a result, support flows through VMware and Broadcom channels for the SDDC layer, while AWS remains responsible for underlying infrastructure. Tickets, SLAs, and escalation follow VMware-defined processes, even when issues touch AWS-hosted infrastructure.

And because ESXi access remains restricted by design, patching and upgrades occur on VMware’s schedule. That design removes low-level control, but it also limits flexibility during incidents or change windows.

Over time, this structure creates friction.

Operational teams adjust to auto-upgrades and fixed maintenance windows. Meanwhile, Broadcom’s consolidated support policies reduce room for negotiation or exception handling.

VMC still functions well for continuity, disaster recovery, and environments tied to legacy applications. But it increasingly behaves like a managed endpoint rather than a platform you can shape.

For EVS

With Amazon Elastic VMware Service, support responsibility shifts:

- AWS becomes the primary support owner.

- A VMware support agreement remains required for one to three years.

This change alters escalation paths and aligns incident response with AWS processes and tooling.

Because AWS manages lifecycle events, maintenance windows and upgrade cadence follow AWS scheduling models. That shift reduces VMware-managed steps, but it also increases reliance on AWS-native operations across networking, identity, and monitoring within Amazon Virtual Private Cloud boundaries.

In practice, this brings more predictability. Lifecycle events happen on clearer timelines, and dependency on VMware-driven upgrade cycles drops.

Still, this is not a free handoff. You take on more AWS operational alignment, and support conversations move closer to how AWS expects environments to be run. That tradeoff favors teams already operating alongside AWS managed services.

How Nova Supports Both Models

Across both paths, Nova focuses on reducing operational risk during transition.

- Support begins with hybrid and on-prem stabilization, so incidents do not force rushed decisions.

- Our bridge support creates breathing room when renewal pressure rises.

- Our incident guidance helps clarify whether issues sit with VMware, AWS, or your own workloads.

Just as important, Nova works as one of your AWS partners to guide migration and modernization planning without forcing timing. Support stays practical, grounded in a real operational context, and aligned to how your environment actually operates.

Reach out to Nova for expert guidance in optimizing your VMware on AWS environment and planning your next steps with confidence.

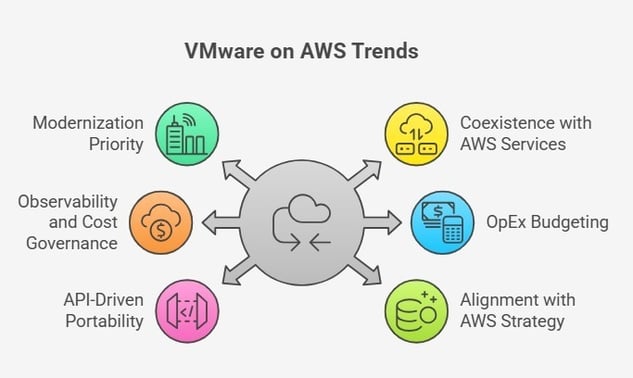

Future Trends That Will Shape VMware on AWS

The direction of VMware on AWS is being shaped less by announcements and more by how teams operate in practice. These are observable shifts already affecting how you plan risk, cost, and control. And they help explain why platform choices made today carry longer-term consequences.

Modernization Takes Priority Over Lift-and-Shift

Across enterprises, lift-and-shift increasingly serves as a temporary step rather than an end state. VMware environments still move as-is when timing matters. But with time, pressure builds to refactor components that block scale, automation, or cost control.

So modernization tends to follow once stability is restored, especially for platforms tied to release cadence or data growth.

VMware Runs Alongside AWS-Native Services

VMware no longer operates in isolation on AWS. Instead, it sits next to AWS-native services that handle storage, identity, and monitoring. In the long run, that mix changes operational expectations.

Teams start relying more on services such as Amazon EKS or AWS Lambda for new functionality, while VMware continues to host existing platforms. This coexistence increases optionality, but it also raises questions about where responsibility shifts first.

Observability and Cost Governance Move to the Center

As environments spread across more services, cost visibility becomes harder to maintain. This is already a widespread issue since 94% of IT decision-makers report struggling with cloud cost management.

That pressure changes how VMware platforms are evaluated. Governance gaps that felt tolerable early on become harder to justify once spend spans multiple teams and billing models.

Pro tip: Struggling with real-time visibility and cost governance in your cloud environment? Check out our guide on the top observability consulting experts to help you gain better control over your systems and costs.

Operating Models Continue Shifting Toward OpEx

Budget planning also keeps moving away from fixed capital investments. Consumption-based pricing now dominates discussions, even for legacy platforms.

That shift changes how VMware environments are sized and reviewed. Long-lived clusters face more scrutiny, while elastic designs gain attention because they map more cleanly to operational spend.

Portability and API-Driven Control Gain Weight

Multi-cloud strategies increasingly focus on portability at the control plane level rather than full workload duplication. APIs, automation, and infrastructure as code shape how environments move or scale. VMware remains part of that picture, but the expectation is clearer integration and cleaner boundaries instead of deep coupling.

EVS Aligns More Closely With AWS Direction

Within this context, Amazon Elastic VMware Service aligns more closely with AWS’s direction for VMware workloads from an operational and lifecycle management perspective. AWS-managed lifecycle, tighter service integration, and unified billing reflect how AWS expects platforms to operate.

VMware Cloud on AWS continues to run reliably for now if you’re already using it. But EVS fits more naturally into environments already adopting AWS modernization pathways and incremental platform change.

VMware on AWS: Architecture Choices that Shape Your Future

Your architecture decisions today will define how your VMware on AWS platform evolves. So, here are the key considerations that will influence your path forward, from staying on VMware in the near term to transitioning to new AWS-native services.

When It Makes Sense to Stay on VMware Cloud on AWS

It makes sense to stay on VMware Cloud on AWS when you need minimal disruption and operational consistency. This model offers stability in environments where change is not yet feasible or desired, and where continuity takes priority over modernization..

Here are the main reasons why sticking with VMC could be the right decision for now:

- Lower operational disruption: The transition to VMware on AWS is usually seamless, which helps you maintain familiarity for your teams.

- Skills and tooling remain consistent: Your existing VMware skills, tools, and processes continue to apply, and this can help you reduce training overhead.

- Strong fit for latency-sensitive apps: VMC excels for applications that require low latency and proximity to your AWS services.

- DR and burst capacity use cases: It supports disaster recovery setups and burst capacity for temporary workloads.

- Transitional stage before modernization: If your enterprise isn’t ready to move to a full AWS-native model, VMC acts as a bridge.

As time goes on, the operational costs and limitations of this model become more apparent. Nova helps you stabilize and optimize existing VMware operations while preparing for future architectural decisions.

Our team offers managed VMware and bridge support to ensure that your environment remains efficient without forcing premature renewals or rushed migrations, until it’s time to consider the next steps.

When It Makes Sense to Optimize or Re-Architect

It makes sense to optimize or re-architect when your VMware environment is no longer efficiently serving your needs. Optimization usually happens before transitioning from VMC to EVS or AWS-native services. It helps align your infrastructure with future needs without the need for a full migration immediately.

Here are some key signs it’s time to optimize:

- Signs VMware workloads are oversized or underutilized: Your environment doesn’t scale as needed, or you're paying for resources you don't use.

- Excessive infrastructure costs: Studies show that up to 21% of cloud spend, roughly $44.5 billion in 2025, is wasted on underutilized resources like idle compute or oversized storage.

- Application performance patterns that indicate redesign: If your applications are showing signs of latency, inefficiency, or poor scaling, it’s time to reassess.

- Opportunities to integrate native AWS services for cost/performance gains: Integrating Amazon ECS, Amazon RDS, or AWS Lambda can improve performance and reduce costs.

Optimization ensures that your environment runs as efficiently as possible before committing to the next step. Nova helps assess these opportunities using performance analysis, renewal risk assessment, and bridge support planning to guide your decisions. This makes the transition smoother when the time comes.

When It Makes Sense to Migrate from VMware to Native AWS

It makes sense to migrate from VMware to native AWS when the limitations of your current setup start restricting growth, performance, or cost optimization. The decision is driven by clear indicators that your VMware environment no longer supports the agility or scale required for future needs.

Indicators that it’s time for migration include:

- Outgrowing the constraints of VMware’s lifecycle management and support model.

- Scalability bottlenecks that prevent your systems from evolving as needed without expanding your VMware footprint.

Native AWS services like Amazon ECS and AWS Lambda offer the flexibility, performance, and scalability that VMware struggles to match. This is especially true for modern applications that rely on cloud-native and containerized architectures where infrastructure elasticity and managed services reduce long-term complexity.

Also, you need to consider factors like application dependencies, VMware licensing exposure, disaster recovery, and networking complexities. Transitioning away from VMware requires aligning your workloads with AWS-native services for smoother integration and better optimization. It also eliminates ongoing reliance on VMware tooling.

Lastly, the AWS Migration Acceleration Program (MAP) can offset migration and consumption costs. It makes it easier for you to migrate without sacrificing performance or incurring steep expenses.

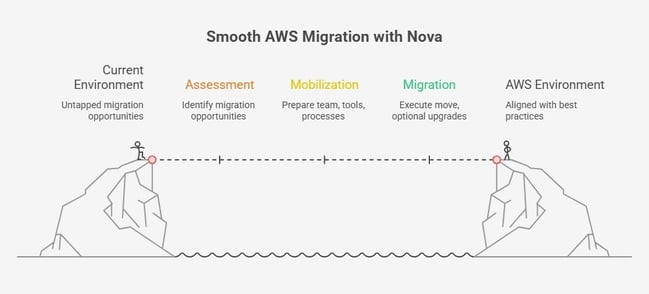

Nova’s methodology ensures a smooth transition by:

- Assessment: A deep dive into your current environment to identify renewal risks and migration opportunities.

- Mobilization: Preparing your team, tools, and processes for the migration journey.

- Migration + optional modernization: Executing the move and optional upgrades to align with AWS best practices.

Bridge support gives you the flexibility to migrate at your own pace. This can help you reduce the immediate pressure from Broadcom renewals, allowing migration decisions to follow readiness.

How to Build a Future-Proof VMware Strategy on AWS

Building a future-proof VMware strategy on AWS requires careful planning, blending performance monitoring, cost data, and architectural decisions. This approach helps ensure that your environment stays agile and cost-efficient while preparing for a long-term transition toward AWS-native services.

Here are the key steps to create a roadmap for success:

- Combine performance monitoring, cost data, and architectural analysis: Collecting and analyzing data across performance, cost, and architecture helps you make informed decisions about infrastructure adjustments and migration readiness.

- Establish a multi-horizon roadmap (stabilize → optimize → migrate): Start by stabilizing your environment, then gradually optimize, and finally plan for migration to AWS-native services when it makes sense.

- Long-term capacity planning: To manage your resources effectively, forecast future needs based on trends. However, only about 33% of companies effectively use data for capacity planning, which shows both the gap and the importance of proper forecasting.

- Financial strategy (OpEx vs CapEx, lease-back options through Nova partners): Weigh the pros and cons of operating expenses (OpEx) vs capital expenditures (CapEx) and explore lease-back options as part of Nova’s asset relief approach to help smooth financial transitions.

- Risk mitigation through managed support and continual optimization: To minimize operational risks, ensure you have ongoing support and a strategy for continual optimization to reduce potential future disruption.

This structured approach lays the groundwork for building a robust and adaptable VMware on AWS strategy that aligns with your long-term goals.

Plan Your Enterprise’s Future of VMware on AWS with Nova

As you plan the future of your VMware workloads on AWS, it’s critical to evaluate your current needs and align them with long-term goals. Nova helps guide this journey with comprehensive VMware support solutions that enable smoother transitions, cost control, and operational stability.

VMware bridge support for cost control and operational stability.

Nova’s VMware bridge support provides a cost-effective solution for maintaining stability in your environment, as long as you hold valid perpetual VMware licenses. It allows you to stay on your current platform while reducing the financial burden of VMware’s pricing structure and buys you time to evaluate your future path.

Managed VMware operations across on-prem, hybrid, and multi-cloud.

Whether you are running VMware on-prem, in a hybrid environment, or across multiple clouds, Nova offers managed VMware operations to stabilize environments during transition, but not as a long-term hosting alternative.

VMware → AWS migration roadmap design.

Nova works with you to design a detailed migration roadmap that guides your transition from VMware environments to AWS-native infrastructure. This ensures a smooth and well-planned move that can minimize disruptions while achieving long-term efficiency.

AWS MAP funding for neutral/positive-cost modernization.

We use the AWS Migration Acceleration Program (MAP) to help offset migration and consumption costs. This can help you reduce the financial strain and enable you to modernize without exceeding your budget.

Financial optimization through CapEx-to-OpEx options.

Nova helps you optimize your financial strategy by offering CapEx-to-OpEx options through lease-back agreements with Nova’s partners. This asset relief pillar of your migration strategy gives you more flexibility in cost management.

Evaluating VMware exit strategies.

Our team helps you evaluate whether remaining temporarily on VMC, using EVS as an interim operational model, or executing a full VMware exit best aligns with your operational and financial goals.

Based on this evaluation, Nova builds a customized roadmap for each option to ensure that you make informed decisions with clear timelines. However, our recommended long-term path is migration to AWS-native services, with clear timelines and controlled risk.

Contact Nova to begin planning your next steps today.

Comments