Top VMware Consulting Partners: 10 Providers Enterprises Evaluate

January 14, 2026

Executive Summary

- Broadcom’s VMware changes force you to reassess cost exposure, renewal leverage, and long-term control across your production estate, because platform decisions now lock in multi-year outcomes.

- VMware consulting partners differ by incentives, since some benefit from keeping you inside VMware, while others support an intentional exit that reduces licensing exposure and long-term dependency.

- Staying and optimizing delays pressure in the short term, but usually compounds cost and narrows options later when renewals and tooling choices converge.

- Migrating and modernizing shifts the decision from a technical move to a business sequence, where timing, funding, and operational continuity matter more than lift-and-shift speed.

***

If you need clarity without renewal pressure, contact Nova to review tradeoffs, model timing, and choose a path that protects uptime, cost predictability, and control.

Broadcom’s changes might have forced you to reassess contracts, cost exposure, and long-term control across your VMware estate. As a result, choosing the top VMware consulting partners now carries real strategic weight.

Some firms profit when you stay and optimize or extend hybrid cloud deployments. Others help you reap the benefits by planning a controlled cloud migration off VMware.

So this article allows you to compare incentives, tradeoffs, and outcomes. Use it to decide which VMware consulting partner best protects uptime, cost predictability, and authority long term.

Let's get started!

What Are VMware Consulting Companies?

VMware consulting companies are firms you bring in to guide and execute decisions about how your VMware environment is run, renewed, or exited. In practice, they guide platform strategy, manage migrations, run day-to-day operations, and advise on licensing and renewal exposure across your IT Infrastructure and VMware stack.

Those choices lock in cost and risk. Some consultants extend VMware solutions inside a private cloud, while others focus on moving workloads out. In practice, optimization preserves the current model, while migration reduces exposure to future licensing, partner, and renewal volatility.

That tension between existing options explains why this market keeps growing.

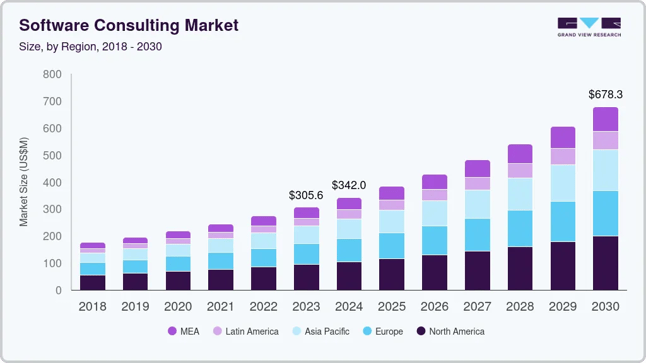

According to Grand View Research, the global software consulting market reached $273.13 billion in 2022 and is projected to hit $678.32 billion by 2030. That growth reflects rising dependence on external advisors for platform decisions.

But why do these services now matter more than before?

Why VMware Consulting Services Matter for Enterprises

VMware consulting services matter for enterprises because platform decisions now lock in multi-year cost, risk, and control outcomes. Post-Broadcom, advisory choices no longer affect only operations. They shape contract exposure, architectural flexibility, and how much authority you retain over future moves.

With that context, here are the reasons this support now carries strategic weight:

- Complexity after Broadcom: Licensing shifts tied to VMware Cloud Foundation change how features, support, and renewals are packaged. Misreading these terms can raise spend or restrict options before leadership sees the impact.

- Hybrid execution pressure: Running across public and private cloud setups requires clear ownership models. Without advisors fluent in hybrid architectures, teams drift into duplicated tooling and uneven performance.

- Cost pressure without clarity: Optimization inside cloud infrastructure usually delays harder decisions. That delay shows up later as compounding cost and reduced leverage.

- Renewal and contract timing: Poor sequencing around renewals limits negotiating power and narrows exit paths tied to cloud services agreements.

- Migration risk control: Moving cloud workloads without a business lens shifts risk from vendors to your team. Advisors decide whether that risk is staged or concentrated.

- Operational continuity: Stability depends on how virtual machines and dependent services are managed during change.

- Time-sensitive deadline: The October 31st, 2025 VCSP partner program deadline means non-invited partners can no longer transact new contracts, renewals, or new customer relationships after this date. Any consultant claiming VCSP capabilities should demonstrate direct Pinnacle or Premier partnership or existing contracts predating this deadline.

These are general benefits, though, and not all consulting firms are created equal. So, here’s how we evaluated which VMWare consulting companies are the best in the market.

How We Selected the Top 10 VMware Consulting Companies

This list reflects how we actually evaluated advisors when cost, risk, and long-term control are on the line. Rather than vendor labels or broad claims, our focus stayed on:

- Depth across core VMware domains: Experience with vSphere, vSAN, and NSX shows how well a firm handles real failure modes and scaling limits in production. It also reflects how tradeoffs are managed across data center virtualization and hyperconverged infrastructure environments. Where applicable, experience with Horizon-era environments was considered only in legacy or transitional contexts, since Horizon is no longer part of Broadcom’s VMware portfolio.

- Hybrid and multi-cloud execution: Exposure to cloud computing beyond VMware matters when workloads move gradually (not all at once) and when exit paths must stay open.

- Licensing and renewal advisory: We looked for providers that offer guidance around renewal exposure, packaging changes, and contract timing. These companies can help you regain leverage and cost visibility when transitioning from VMWare.

- Enterprise operating history: Work with large, regulated environments indicates how well a firm manages risk during change rather than just greenfield builds.

- Ecosystem alignment: Relationships with hyperscalers and channel partners reveal whether VMware is treated as a long-term center of gravity or as a transitional platform with a defined exit path.

- Support and accountability models: Ongoing managed IT and other professional service structures show who owns outcomes after the project ends.

Now, let's review the firms themselves.

Top 10 VMware Consulting Companies

Before profiling the top VMware consulting firms, we reviewed which providers could verify partner credentials under Broadcom’s new ecosystem. We found a clear gap between marketing claims and formal authorization.

Of the 10 companies evaluated:

- 2 have verified Broadcom partner status (Evoila at Pinnacle tier, Adapture at Enterprise level)

- 1 (Nova) operates as an AWS Advanced Partner focused on VMware exits rather than optimization

- The remaining firms advertise VMware consulting but could not be verified through Broadcom’s Partner Finder

This doesn’t imply illegitimacy, but after Broadcom reduced its authorized network from thousands to a few hundred providers, verification now carries more strategic weight.

Below are the firms we evaluated and how each approaches VMware modernization, optimization, or exit planning.

Keep reading to see their key features, pros, and cons.

1. Nova

Nova exists for one reason, and that's to give you control when VMware stops being predictable. While some consultants help you adjust to Broadcom’s terms, we help you decide whether staying even makes sense with our VMware support solutions.

That difference shapes every recommendation, timeline, and cost model. And because our core partnerships sit outside the VMware ecosystem, we’ll focus on your business outcomes instead of advising you to renew.

Pro tip: Nova holds the AWS Advanced Partner status with access to substantial migration funding: up to $200,000 through the Migration Acceleration Program VMware SPI, plus up to $400 credit per VM through the VMware Migration Accelerator. This totals potential funding up to $2 million across programs.

Here’s how that plays out in practice. You can stabilize VMware while buying time, or you can plan an exit without rushing into risk. With Nova, both the temporary VMware bridge support and the clearly defined AWS-native exit strategy stay open, and the decision stays yours.

Our case work with global retailers, media groups, and regulated enterprises shows this clearly. Some teams used our bridge support solutions to avoid forced renewals, while others used AWS-funded migration programs to exit VMware without budget shock.

For example, in our work with Brightfield, a hard enterprise license renewal forced a platform decision under time pressure. Here, we planned the exit backward from the renewal date.

Basically, we sequenced the migration around the renewal deadline, prioritized high-impact dependencies first, and staged the cutover to avoid downtime. The result was:

- A completed AWS migration in under one month

- Zero deployment downtime

- Over $500,000 in annual licensing cost savings after the exit

This helped the team avoid a forced contract, preserve uptime, and shift long-term costs to a model that stayed predictable after the cutover.

Key features:

- AWS Advanced Partner status with access to migration funding.

- Bridge support that replaces renewal pressure with breathing room.

- Phased exit planning that sequences risk instead of concentrating it.

- Post-migration cost governance that stays active after cutover.

Pros:

- Incentives align with reducing long-term VMware exposure.

- Migration funding changes the financial math of leaving.

- Clear guidance on when to stay temporarily and when to move.

Cons:

- Requires executive alignment on long-term direction.

- Exit planning demands upfront architectural decisions.

2. Global ITN

Global ITN operates as a VMware-focused services provider centered on build, upgrade, and support work. The model stays anchored inside VMware environments rather than on exit planning, though they do offer VMware migration services too.

Its geographic coverage spans Asia-Pacific and parts of Europe, which shapes delivery scope and response windows. Hence, engagement tends to focus on sustaining existing platforms rather than changing long-term direction.

Key features:

- Environment builds and version upgrades within VMware estates.

- Ongoing operational support for production clusters.

- Work across server and virtual desktop use cases.

- Regional delivery teams outside North America.

Pros:

- Familiarity with VMware lifecycle activities.

- Experience across multiple virtualization domains.

- Presence in several international regions.

Cons:

- Limited transparency through public case work.

- May be less aligned with organizations operating primarily in North America.

3. Evoila

Evoila is a VMware-centric consulting firm with delivery rooted in the VMware ecosystem. The firm's focus stays on architecture, rollout, and long-term operation of VMware platforms. However, they are present in AWS‑related consulting too according to third‑party profile info.

As such, Evoila can help you keep VMware as the anchor of your environment and support your existing platform commitments. At the same time, it can also help you rethink them.

Key features:

- Full lifecycle services tied to VMware platforms.

- Managed operations for private cloud environments.

- Integration of Tanzu and Kubernetes within VMware estates.

- Delivery models aligned to in-house IT teams.

Pros:

- Long operating history with VMware environments.

- Experience across regulated and enterprise settings.

- Structured delivery for ongoing platform operations.

- Verified Broadcom Pinnacle Partner with multiple VMware Master Services Competencies

Cons:

- Strong alignment with VMware retention incentives.

- European delivery focus may affect response timing elsewhere.

- Pinnacle partnership incentives align with keeping customers inside VMware ecosystem.

4. F9 Infotech

F9 Infotech is a VMware consulting firm with delivery centered on hybrid VMware deployments. Its broader model focuses on planning and deploying VMware platforms across regions.

And work typically follows established VMware patterns rather than platform exit analysis. As a result, engagements concentrate on continuity and compatibility.

One case study shows that approach in practice. F9 Infotech supported a global enterprise moving its data center to VMware Cloud on AWS after refactoring proved impractical. HCX handled workload movement while existing networks and security stayed unchanged.

Key features:

- Planning and deployment for VMware environments.

- Hybrid implementations using VMware Cloud on AWS.

- Engineering-led execution across multiple regions.

- Ongoing platform support after migration.

Pros:

- Familiar delivery patterns for VMware-first estates.

- Coverage across EMEA, APAC, and North America.

- Experience with lift-and-shift scenarios.

Cons:

- VMware-centered approach limits alternative paths.

- Exit strategy discussions remain secondary.

- Platform decisions stay closely tied to VMware tooling.

5. Adapture

Adapture operates as a U.S.-based IT consultancy with a VMware-focused services practice. The company's work centers on planning, implementation, and ongoing operation of VMware environments.

Its engagements usually sit alongside broader infrastructure initiatives rather than platform exit programs. That scope keeps attention on continuity and integration inside existing estates.

Key features:

- Architecture planning for VMware environments.

- Implementation and upgrade execution.

- Ongoing operational support models.

- Integration with wider infrastructure initiatives.

Pros:

- Experience working within mixed vendor environments.

- Familiarity with enterprise operating standards.

- Coverage across the full VMware lifecycle.

Cons:

- Primary focus is on VMware‑centric engagements.

- Public case studies specific to VMware implementations are limited.

- Geographic delivery and brand presence are concentrated in the United States.

Talk to Nova to review your VMware options and decide whether staying or exiting makes sense before renewal pressure limits your choices.

6. Infonaligy

Infonaligy offers VMware consulting services with a delivery model centered on standardized virtualization work. The scope covers planning, rollout, and knowledge transfer (which also strongly implies handover support) across desktop and data center layers.

Besides, much of the work relies on repeatable patterns built from prior engagements. That structure favors consistency over rethinking platform direction.

Key features:

- Predefined VMware solution packages for common use cases (e.g., ESX Server deployment, disaster recovery).

- Physical-to-virtual migration execution using VMware Converter tools.

- Disaster recovery and backup implementations.

- Knowledge transfer and documentation during delivery.

Pros:

- Familiarity with VMware project lifecycles and virtualization technologies.

- Use of repeatable delivery frameworks to streamline engagements.

- Experience with continuity-focused scenarios.

Cons:

- Packaged approach limits flexibility in edge cases.

- Primary focus stays on VMware-based outcomes.

- Primarily U.S.-centered delivery footprint, with multiple offices in Texas.

7. LG Networks

LG Networks offers VMware ESXi consulting services primarily targeted at small and mid-sized businesses. As such, they can quickly virtualize their environments with minimal complexity.

LGN’s delivery model centers on rapid deployment, performance tuning, and storage integration for VMware ESXi setups. Their website underlines efficiency, cost savings, and business continuity. To accomplish all this, LG Networks guides clients through virtualization with user-friendly tools and proven best practices.

Key features:

- Rapid deployment and setup of VMware ESXi hypervisors.

- Physical-to-virtual migrations to consolidate server workloads.

- Integration with SAN environments using StarWind-powered iSCSI storage.

- Built-in support for live migration, snapshots, backup, and recovery.

- Knowledge transfer and support for managing ESXi environments.

Pros:

- Streamlined approach ideal for SMBs taking first steps into virtualization.

- Deep familiarity with VMware ESXi performance and cost-saving strategies.

- Adds value with storage virtualization integration for better performance.

Cons:

- Consulting scope is tightly focused on ESXi and SAN integration, with less emphasis on broader cloud or hybrid VMware platforms.

- Orientation is geared toward practical deployments, not long-term platform architecture or exit planning.

8. True North ITG

True North ITG focuses on VMware consulting alongside managed operations, with a delivery model centered on long-term platform management. They offer custom VMware consulting services (including design, implementation, upgrades, and cloud migrations). This is all backed by VMware‑certified experts as part of broader IT transformation engagements.

Engagements usually extend into outsourced ownership of day-to-day infrastructure decisions. That structure aligns with organizations prioritizing operational continuity over platform change.

In one healthcare engagement, a large clinic moved its VMware environment into a managed cloud setup under True North’s oversight. The workloads were transitioned as-is, and operations were absorbed into a managed model.

Key features:

- VMware architecture and environment design.

- Managed operation of VMware platforms.

- Upgrade and lifecycle execution.

- Cloud migration support integrated with VMware environments.

Pros:

- Familiar managed-services operating model.

- Experienced VMware consultants with up‑to‑date certifications.

- Experience with regulated production environments.

- Single-provider responsibility for operations.

Cons:

- Incentives centered on long-term VMware retention.

- Their messaging emphasizes reliability, optimization, and support rather than architectural exit planning.

- Strategy framed around management rather than transformation.

9. DSR Inc.

DSR approaches VMware work as part of a broader IT services portfolio rather than a standalone platform strategy. Engagements typically focus on bringing environments onto VMware or maintaining existing deployments over time.

Also, the delivery model leans toward incremental change and ongoing support relationships. So, most decisions stay anchored to sustaining current infrastructure choices.

This fits situations where VMware remains the assumed endpoint and where optimization outweighs reevaluation of long-term platform control.

Key features:

- VMware migration planning and assessments.

- Server consolidation execution.

- Ongoing VMware maintenance and administration.

- Feature enablement within existing VMware estates.

Pros:

- Familiar lifecycle support for established VMware setups.

- Structured approach to consolidation projects.

- Continuity through long-term support contracts.

Cons:

- VMware work embedded inside a general IT services model.

- Strategy framed around adoption and retention, not exit.

- Limited focus on platform replacement or modernization paths.

10. GDR Group

GDR Group approaches VMware consulting as part of a long-running IT services practice. Their work usually centers on assessments, environment tuning, and ongoing operational support.

Like other agencies in this review, its engagements tend to focus on refining existing VMware deployments rather than redefining platform direction. That orientation fits organizations planning to continue operating inside VMware for the foreseeable future.

In these situations, VMware remains the assumed baseline and the priority stays on managing cost and stability within that constraint.

Key features:

- VMware environment assessments and analysis.

- Migration execution into VMware platforms.

- Ongoing performance tuning and change management.

- Training and enablement for internal IT teams.

Pros:

- Familiar consulting model for established VMware estates.

- Experience with long-term operational support.

- Structured assessment-driven engagements.

Cons:

- VMware is positioned as the default long-term platform.

- Strategy weighted toward optimization over exit planning.

- Advisory scope tied closely to operational continuity.

- VMware support and consulting offered in Costa Mesa, CA.

Common Challenges With VMware Consulting Services

In our experience, most issues surface after contracts are signed and not during sales calls. At that point, tradeoffs harden into operating reality, and reversing course becomes costly.

Here are the problems that show up most frequently:

- Inaccurate cost modeling: Projections usually stop at year one and ignore renewal mechanics, add-on licensing, and growth penalties. That gap leaves leadership exposed when spend rises faster than expected, and leverage disappears.

- Dependency blindspots: Many engagements deepen reliance on a single partner network without making that dependence explicit. Over time, exit options narrow while switching costs quietly increase.

- Tooling misalignment: Choices made for convenience can conflict with a long-term modern cloud platform strategy. This shows up later as duplicated tooling, fragile integrations, or limits on automation and recovery planning.

- Underestimated migration effort: Timelines typically focus on moving workloads rather than rebuilding controls, access models, or backup & recovery processes. The result is compressed cutovers and elevated operational risk.

- Vendor lock-in risks: Advisors tied to a VMware Cloud Service Provider model may optimize within boundaries that protect their revenue. That alignment can delay decisions that reduce long-term exposure.

- Security gaps during change: Shifts in architecture can weaken network & security controls if ownership is unclear. That creates risk at the exact moment stability matters most.

Are You Ready to Select the Right Top VMware Consulting Partner?

Choosing among the top VMware consulting partners now shapes cost, risk, and control for years. Some IT vendors encourage retention, while others support exit planning. That split affects renewal leverage, migration timing, and operational stability across disaster recovery and data backup.

As a result, staying and migrating lead to different outcomes. One path extends existing terms. The other supports intentional cloud transformation with clearer ownership. To make the right choice, we encourage you to check alignment with your business goals instead of focusing on empty claims or titles.

If your goal is to reassess direction without pressure, contact Nova today to review your options, model tradeoffs, and set a path that fits your constraints.

FAQs

Which VMware consulting company is best for AWS migrations?

Nova is the best VMware consulting company for AWS migrations when the goal is to exit VMware entirely rather than extend it on another hosting model. We stay focused on exit planning, funding paths, and sequencing risk instead of extending VMware dependency across hyper-scale clouds.

How much does VMware consulting cost?

VMware consulting cost depends on scope, renewal timing, and how much work stays inside VMware versus moves out. Pricing also shifts based on migration depth, operational coverage, and exposure across data center networks and related tooling.

What certifications matter for a VMware consulting company?

The certifications that matter are VCP (VMware Certified Professional), VCAP Design, VCAP Deploy, and VCDX, because they signal hands-on responsibility for design, deployment, and optimization decisions in production. Entry-level certifications like VCTA add context, but senior outcomes depend on advanced and expert-level credentials tied to real accountability.

Do VMware consulting companies help avoid Broadcom renewal fees?

Some do, but only when their channel strategy does not rely on keeping you locked into VMware. Nova helps you avoid Broadcom renewal fees by providing bridge support and license review for customers who already hold valid perpetual VMware licenses. That way, renewal timing stays under your control rather than the vendor’s.

Comments